Qantas Airways on Thursday, this week announced an agreement with Emirates after months of speculation. Qantas CEO Alan Joyce called it “the biggest deal in Qantas history“. Qantas have publicly declared it is “The World’s Leading Airline Partnership”

The ten year deal, yet to be approved by the Australian Competition and Consumer Commission (which I see as a formality) means Qantas will

- shift its main hub for London flights from Singapore to Dubai

- fly daily Airbus A380 services from both Sydney and Melbourne to London via Dubai adding to Emirates 84 services a week out of Brisbane, Melbourne, Perth and Sydney

- cease its 17 year long revenue-sharing agreement with British Airways in March 2013 on the “Kangaroo route” between Australia and Britain – a relationship that has existed in some form since the flying boats that used to ply this route decades ago

- will stop its daily Sydney-Frankfurt and Melbourne-Frankfurt flights from April next year which lose money

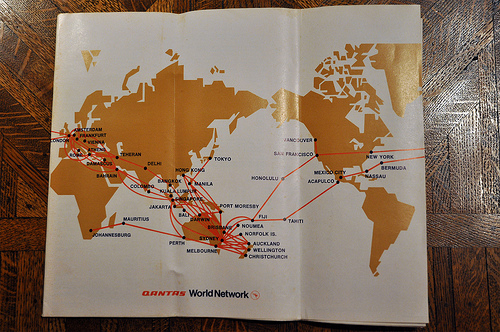

- make London its only European port (Qantas also used to fly to Amsterdam, Athens, Rome and Vienna)

- code share on Emirates flights between Australia and New Zealand

Qatar is now locked out of an alliance with an Australia domestic carrier. This is where it could get very interesting. British Airways Holding parent Company IAG had held discussions with the Doha-based Qatar over the purchase of the 12 per cent stake in IAG. There was intense UK media speculation that IAG would develop a new alliance with Qatar which would give BA reach into Asia and Australia. It does not give Qatar access to the Australian domestic market unless they take on Tiger Australia or REX (both scenarios are unlikely).

On the day the deal was announced, Qantas shares leapt almost 7 per cent. However, following the announcement Standard & Poor’s who placed Qantas on negative credit watch on June 7, 2012, lowered Qantas’s corporate credit rating from BBB/A-2 to “BBB-/A-3” over concerns that “Qantas’ business risk profile has weakened because of the structural pressures affecting the airline’s international business”. They noted the flow on effect of the Emirates deal “may take some time to eventuate”. The Standard and Poor announcement came after the close of trading on the Australian Stock Exchange, so it will be Monday Australian time, before we see the effect on their share price.

So the deal, I think “saves” Qantas International (and Alan Joyce’s job), at the expense of fewer direct Qantas destinations, a reduction in Qantas services, a farewell to the historic Kangaroo route and inevitable job losses. The deal does not change Qantas cost base or its acrimonious relationship with its staff. Longer term, I actually see this deal as another nail in the coffin for Qantas International. Qantas is now tied to Emirates. It makes it very hard to develop alliances with any other carriers. I wonder long how it will be before Emirates becomes Australia’s international airline with Qantas becomes simply a domestic carrier or Jetstar looking after international routes.

So the deal, I think “saves” Qantas International (and Alan Joyce’s job), at the expense of fewer direct Qantas destinations, a reduction in Qantas services, a farewell to the historic Kangaroo route and inevitable job losses. The deal does not change Qantas cost base or its acrimonious relationship with its staff. Longer term, I actually see this deal as another nail in the coffin for Qantas International. Qantas is now tied to Emirates. It makes it very hard to develop alliances with any other carriers. I wonder long how it will be before Emirates becomes Australia’s international airline with Qantas becomes simply a domestic carrier or Jetstar looking after international routes.

Related:

Qantas and Emirates joint website

Awards confirm Qantas Service Plunge

And the new Qantas Dance Partner is…

Qantas -Back to or Ready for the Future

[…] Qantas and Emirates– another nail […]