There are very few success stories in the airline world about bankrupt airlines. The trading of Japan Air Lines (JAL) shares, this week, on the Tokyo Stock Exchange after a two and a half year absence, was welcome news. Generally, when a flag carrier fails, it vanishes. Consider Malev and Pluna this year. When Japan Air Lines failed on January 19, 2010, it had a phenomenal $US 25 billion in debts. One would have assumed that would be farewell. Instead, the carrier is flying high after its massive $US8.5 billion float on the Tokyo Stock Exchange a few months ago, 45 new Boeing 787s on order and a slimmed down cost structure. Albiet with a lot of help from the Japanese government and Japanese banks.

In the months up to the collapse, many options were considered for the airline founded in 1951. One was a merger with All Nippon Airways (ANA). Another was foreign majority ownership. Three carriers were considered: Air France-KLM, American and Delta. A switch to Air France of Delta would mean a switch from One World Alliance to Skyteam. This did not happen and JAL stayed with One World.

To facilitate the recovery process, JAL received an injection of 350 billion yen (about $US4.5 billion) from ETIC (The Enterprise Turnaround Initiative Corporation of Japan), a government backed fund. Banks also forgave about 520 billion yen in debt. The ETIC has actually made four billion dollars profit from the recent IPO.

Then Chairman Emeritus Dr Kazuo Inamori arrived at JAL in February 2010 to rescue the carrier. He went on record for saying he hated the airline’s service and prior to his Chair role, would refuse to fly them. He introduced a set of business principles he had developed at Kyocera, the company he founded at the age of 26. One initiative he introduced was to have every individual business unit within the company be held accountable for maximising profits. All unit leaders met monthly to share cost-saving ideas and competitive intelligence, and are directed to put that information to work immediately, accelerating business decisions. The result was that :

- JAL retrenched a third of its employees

- cut its pension fund benefits

- sold off all its fuel inefficient 747s in 2011 (take note Qantas)

- scrapped almost a third of its routes

- slashed its fleet by 60 planes from 275 in 2007 to 215 in 2011 severely reducing depreciation costs and gaining tax write-offs that will last until 2019

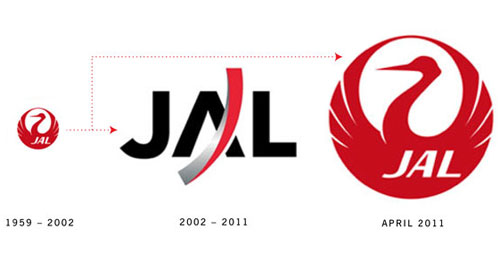

- changed its branding back to the red crane symbol (see below) representing loyalty, honour and good luck

- agreed to form a low cost carrier in a joint venture with Qantas subsidiary Jetstar Airways

- reduced its cost per available seat kilometre from 13.8 yen per per to 11.4 yen. ANA, its major competitor sits at 12.9Yen.

- operating profit margin is one of the highest in the airline world

- improved business and first class cabins with new seats, in-flight menus and (this is Japan) electronic toilet seats

- JAL reported an operating profit of Y204.9 billion for the financial year to March, 2012- an impressive profit margin of 17%

Today, JAL is rated by Skytrax as a four star airline. They fly to 70 destinations in 20 countries and remain firmly in the One World Alliance. I have yet to fly them but am eager to get onto one of their 787s.

They are now profitable and look certain to be flying for many years in the future. . The greatest fear, of course, is that JAL will not maintain the discipline gained through the last few months and slide back into financial trouble. Dr Inamori is confident JAL have learnt and are resilient enough to face the future.

Actually, the main reason that JAL has become profitable is that they are getting HUGE tax breaks (roughly $1 billion per year) and will continue to do so for 9 years!

This is one of the reasons why ANA has complaining about JAL’s unfair advantage.

http://mobile.businessweek.com/news/2012-08-28/japan-air-may-lose-74-billion-yen-tax-breaks-in-opposition-bill

I think you wrote a typo in the last paragraph “not” -> “now” maintain the discipline gained through the last months?

Yes, ANA is citing unfair advantage and I am not sure how this will play out. The depreciation situation and bank forgiveness helped save JAL and will help JAL for the period you mention.. It seems to me though their cost reductions and improved service are the most significant factors in their day to day profitability.