At a Qantas media conference today, the public were informed that the group made a statutory loss after tax of $244 million. Its first loss for 20 years. The group had a $95 million profit before tax. Again, Qantas shareholders will receive no dividend. Record high fuel costs of $4.3 billion, up $645 million made a major dent.

We also found out the cost of the industrial action and grounding of the Qantas fleet ($194 million). What we didn’t find out was the actual cost of the industrial action versus the grounding. Of the industrial action, some cost the company nothing (for example the Pilots wearing red ties and making political comments on flights). Some would have cost it some money (for example the rolling one hour stoppages). The biggest impact, however was the stranding of 100 000 people and the cost of that.

Citing these results amidst the Global Financial Crisis, Qantas also announced it has cancelled firm commitments for 35 Boeing 787-9s – reducing capital expenditure by US$8.5 billion at list prices. The same 787 , Qantas has previously said was the cornerstone of its domestic and international fleet renewal program

It will keep options and purchase rights for 50 787-9, available for delivery from 2016. Receipt of the first 787-9 will be delayed two years due to the restructure, Qantas said.

There are no changes to its plans for the 787-8, with the first of 15 jets scheduled for delivery in the second half of 2013.

Group CEO Alan Joyce said “Qantas continues to practice disciplined capital management and, in the context of returning Qantas International to profit, this is a prudent decision…The 787 is an excellent aircraft and remains an important part of our future. However, circumstances have changed significantly since our order several years ago. It is vital that we allocate capital carefully across all parts of the Group.”

No new planes. No new routes. A continued shrinking of existing routes. No new partner (what happened to Qatar or Etihad?), no new premium Asian carrier. No reconciliation with workforce No answers. Is this the restructuring of Qantas International or another nail in the coffin?

In the same announcements today, we heard how Jetstar had “underlying EBIT of $203 million, up $34 million 20 per cent on the prior year. Ancillary revenues grew by 27 per cent and unit costs were reduced to record lows. Domestically, Jetstar continues to hold a clear leadership position in the price-sensitive market. Jetstar Japan commenced operations in July 2012 and Jetstar Hong Kong will be added in 2013.

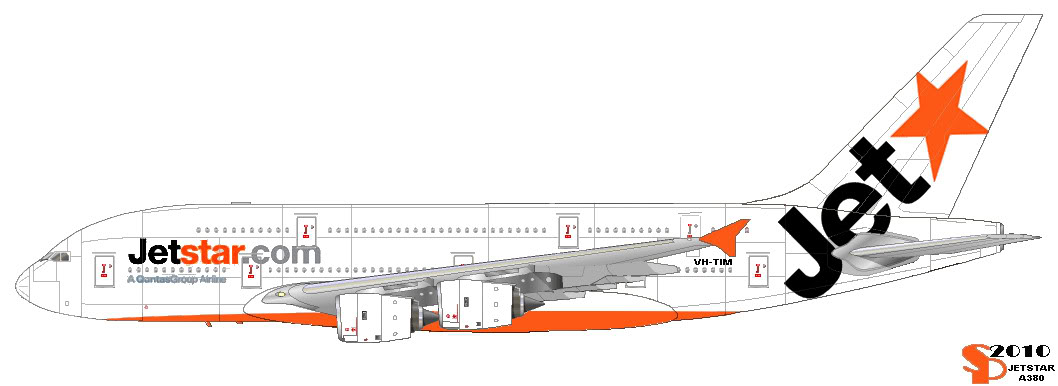

So in 2015, what are the chances we will have Jetstar planes flying internationally with Qantas only flying domestically? No new 787s needed then? Will we see A380s in Jetstar colours? Picture from Minigroover at 400scalehanger

Related Posts

Leave a Reply